south carolina inheritance tax 2021

Inheritance tax rates typically begin in the single digits and rise to a max of anywhere between 15 and 19. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax.

Revealed Living In South Carolina Vs North Carolina This May Surprise You Youtube

Floridas corporate income tax rate declined from 55 to 44458 percent in September 2019 effective for tax years 2019-2021.

. Impose estate taxes and six impose inheritance taxes. South Carolinas taxation of retirement income is more favorable. North Carolina has a higher property tax as a percentage of home value.

Twelve states and Washington DC. 46 latest estimate by the Bureau Of Labor Statistics Population. 34 -20 days year over year Median Rent Price.

I even hold a SOUTH CAROLINA TITLE CLEARNING FORM THAT WAS FIED IN CLECK OF COURT IN MARION SC 29571 AS WELL. Heres how to protect yourself and your family from inheritance thieves. Those who moved for a new job migrated to high-income areas like Washington DC.

Inheritance theft is an underreported problem that can cost families dearly. The inheritance tax ranges from 5 to 15 depending on the amount of the inheritance and the relationship of the recipient to the decedent. South Carolinas median property tax rate is 573.

248950 1-Year Appreciation Rate. Inheritance tax is only applied if the amount is above each states threshold and is assessed on the amount that exceeds that threshold. Maryland is the only state to impose both.

Whereas 60 of Americans moved for their career in 2015 just 33 did so in 2021. Murrell Smith R-Sumter left talks to Rep. Sales tax in North Carolina is 125 lower compared to South Carolina.

10488084 latest estimate by the US. South Carolina has a higher tax rate along with slightly higher exemptions. North Carolina Housing Market Overview.

Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as. She knew that she had to use various trust funds to avoid probate and an. Muscular Dystrophy Association National Office.

Notable Ranking Changes in this Years Index Florida. Pennsylvania South Carolina South Dakota Tennessee Texas Utah Virginia West Virginia. 154 Median Days On Market.

However local taxes can reduce the difference. Gilda Cobb-Hunter D-Orangeburg right before he is chosen as speaker-elect on Thursday April 28 2022 in Columbia SC. Improving Lives Through Smart Tax Policy.

A Guide To South Carolina Inheritance Laws

South Carolina Retirement Tax Friendliness Smartasset

South Carolina Inheritance Laws King Law

South Carolina Retirement Taxes And Economic Factors To Consider

South Carolina Estate Tax Everything You Need To Know Smartasset

South Carolina Estate Tax Everything You Need To Know Smartasset

South Carolina Sales Tax Small Business Guide Truic

South Carolina Landlord Tenant Laws Update 2020 Payrent

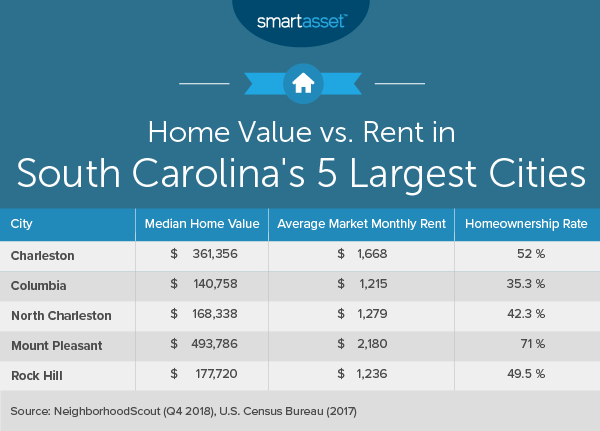

Cost Of Living In South Carolina Smartasset

A Guide To South Carolina Inheritance Laws

South Carolina Income Tax Calculator Smartasset

Where S My Refund South Carolina H R Block

South Carolina Estate Tax Everything You Need To Know Smartasset

Real Estate Property Tax Data Charleston County Economic Development

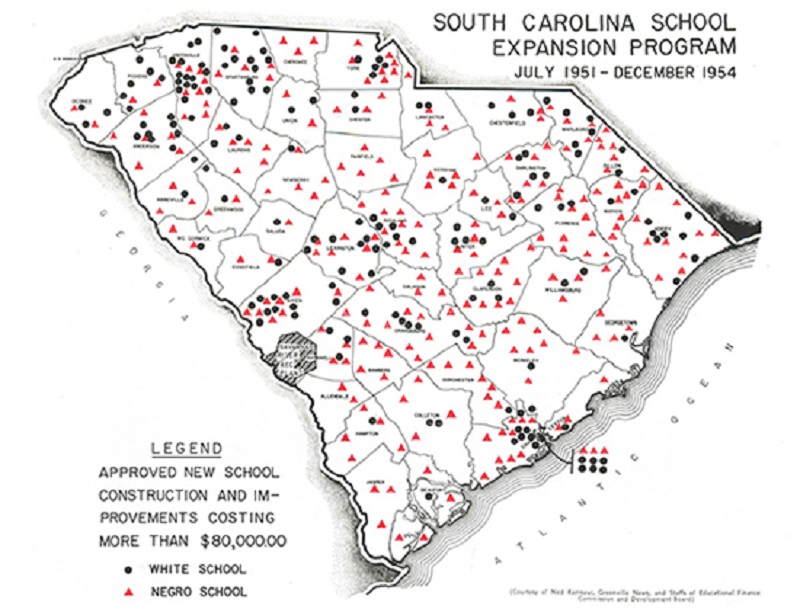

Separate But Equal South Carolina S Fight Over School Segregation Teaching With Historic Places U S National Park Service

The True Cost Of Living In South Carolina

Ultimate Guide To Understanding South Carolina Property Taxes